How Nuclear Energy Could Easily Beat Floating Offshore Wind in Norway

Nuclear power delivers electricity all year round, which makes it profitable even though it can be expensive to build.

«Price is what you pay. Value is what you get” -Warren Buffet

I have taken a closer look at the Norwegian Energy Regulatory Authority’s (NVE's) figures on the costs of power production. Here, floating offshore wind and nuclear energy cost the same in terms of installed capacity. However, when comparing other factors, nuclear energy has some additional advantages over offshore wind:

According to NVE, nuclear energy produces 65 % more electricity because it runs continuously throughout the year.

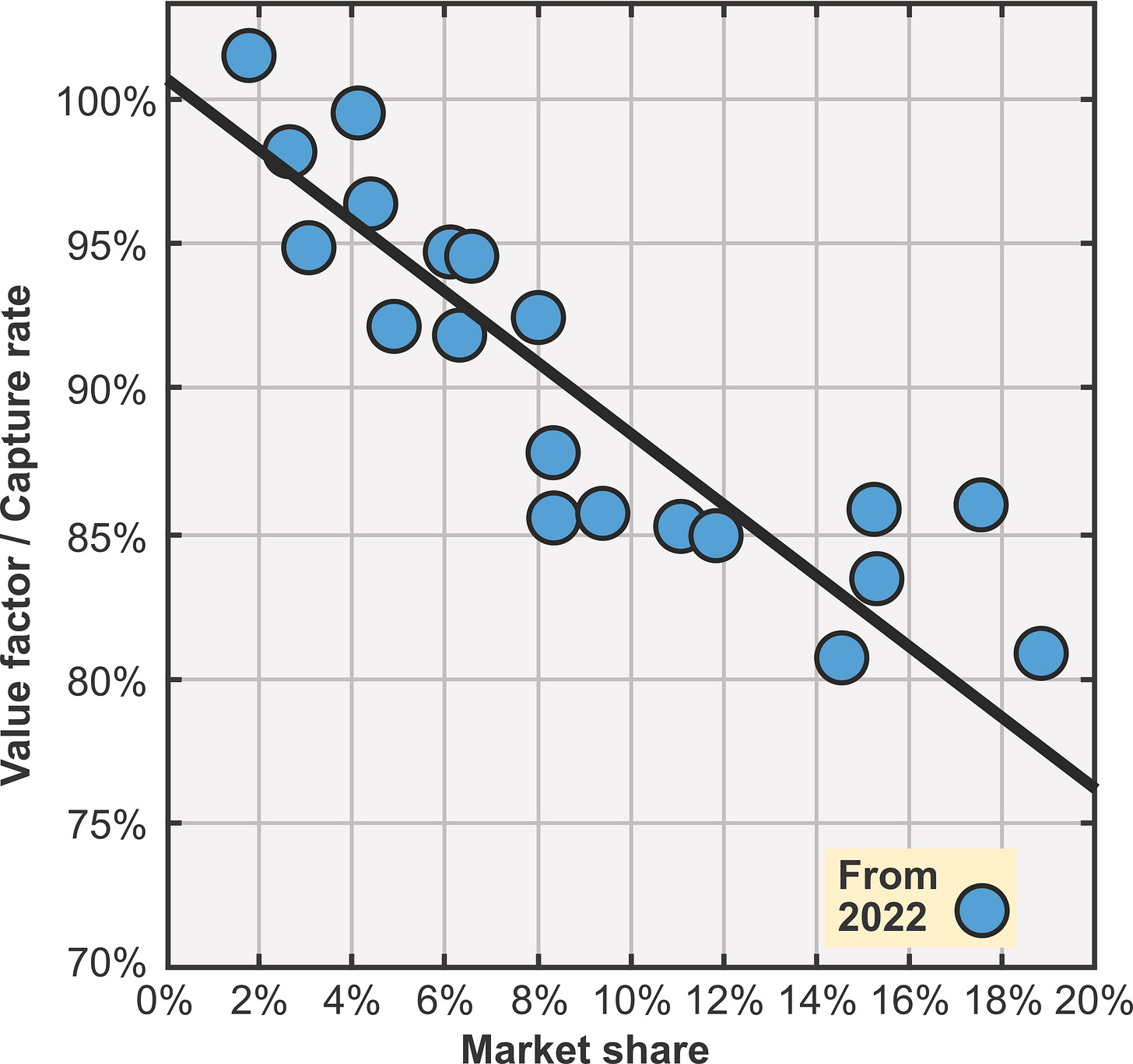

The electricity from nuclear energy is more valuable because it generates power during periods of energy drought. According to historical data from Germany, land-based wind power at scale can have a value factor as low as 70 %, with an 18 % market share, while nuclear energy will be guaranteed a 100 % value factor as it operates 24/7. The value factor can even be higher by planning maintenance during periods of low load (i.e., low electricity prices).

Nuclear energy has operating costs (OPEX) that are 31 % lower than floating offshore wind.

The lifespan of nuclear energy is more than three times longer. That is, 80 years, including lifespan extension.

Based on all these assumptions, we obtain a cash flow that undoubtedly favors nuclear energy. Figure 1 below shows that nuclear energy is profitable while floating offshore wind is struggling, with a power price of 60 øre/kWh (~6 cents/kWh). This is even considering that offshore wind becomes significantly cheaper to build over time, with a 42 % reduction in 2055 and a 50 % reduction in 2084.

The assumption of the drop in value factor is based on data from Germany, which has experience with a high share of wind power. As seen in Figure 2 below, the relative value of wind power diminishes with market share, which is called the “self-cannibalization effect.” In plain economics, it implies that if the supply of a good – say, wind power – increases, its relative price declines.

This effect can be combated by including more storage flexibility in the power system, such that “cheap” power can be moved to periods of “expensive” power. The challenge remains to scale this energy storage to a size that can reduce this cannibalization effect. Current projections from Wood Mackenzie on grid storage are that Europe can store approximately 10 minutes of its power in 2031. Hence the challenge to combat the cannibalization effect is immense. Moreover, Norway is approaching a power adequacy crisis toward 2030, mainly due to a lack of firm dispatchable hydropower capacity, according to NVE.

All assumptions to create the cumulative cash flow analysis in Figure 1 are taken from Table 1 below. Most of the numbers are based on NVE's figures on the costs of power production. The only exceptions are the assumption of value factors and the opportunity for lifetime extension of nuclear energy production facilities beyond the design lifetime.

With nuclear energy, we can enter the year 2100 with revenues that are more than four times greater than the investment. The internal rate of return on the investment is estimated to be around 5 %. Meanwhile, floating offshore wind is experiencing significant financial losses and is far from turning a profit. Nevertheless, there is some uncertainty regarding development costs and electricity prices in the future. However, this calculation provides an indication of the direction we are heading in.

Firstly, Norway has experienced historically low electricity prices. Now, Norway is more closely connected to Europe, where increased electricity prices are expected. High-marginal-price energy sources such as coal and gas power are used here to maintain balance in the power system.

Prices will likely increase in the future, driven in part by increased carbon taxes and other climate measures such as the use of carbon capture in coal and gas power plants, as well as extensive balancing power to ensure a stable electricity supply.

Regardless of the outcome, the relative difference between nuclear power and floating offshore wind will remain valid in the future.

Secondly, power developments abroad will also impact profitability. The more offshore wind is developed, the lower electricity prices will be when it's windy in the North Sea. In such a scenario, the electricity from nuclear power could become even more valuable than what we assume because electricity prices can skyrocket when there is an energy drought.

In DNV's energy transition scenario, electricity from Norwegian offshore wind will be so unprofitable in the power market that around 75 % of floating offshore wind should be used to produce hydrogen.

Thirdly, there are significant uncertainties regarding the development costs of nuclear energy and floating offshore wind.

Onshore wind power has undergone a 15-fold increase in turbine size over the past decades, which has driven down costs. For floating offshore wind, there are only marginal increases in turbine size, which means that less turbine cost reductions should be expected. Additionally, the floating foundation and anchoring are highly material-intensive, which might diminsh any learning curve gains as material costs are most prevalent.

There are also significant uncertainties regarding the development of nuclear energy. In the Western world, nuclear energy development over the past decades has revolved around individual prototypes or first-of-a-kind (FOAK) reactors. However, in other parts of the world, multiple standardized power plants are being built simultaneously, resulting in construction costs that are half the price compared to NVE's estimates.

Another wildcard is the so-called Small Modular Reactors (SMRs). Not only are they intended to be standardized, but also mass-produced in factories, reducing construction time by more than half. GE Hitachi estimates that their modules can cost less than half of what NVE assumes when series production is fully underway. Moreover, decentralized power produced from SMRs can be located closer to the power demand, reducing the need for grid expansions and lowering the costs of power transmission.

In light of the current situation and challenges, our politicians should consider what it takes to achieve profitability in energy policy. In this regard, it would be great if nuclear energy should at least be considered as a potential subsidy-free clean energy alternative.

All this says is that massive renewables do not work well in a pure spot market environment. That's also true of a massive nuclear system (not connected its neighbors, and not having massive hydro as backup, like France or Sweden - if you use these two conditions to 'help' renewables you also get much better results)