Why Small Modular Reactors are Inevitable in Norway's Energy Landscape

SMRs can be profitable without subsidies.

In the ongoing discussions about Norway's energy transition, some argue that nuclear energy, due to its levelized cost of electricity (LCOE), is too expensive to be a viable option. Curiously, these same individuals seem to advocate for the development of Europe's most expensive offshore wind energy. This argument raises concerns and prompts a deeper evaluation of the situation.

It is important to move beyond short-term evaluations of small modular reactors (SMRs) based solely on LCOE. Instead, we should assess their long-term profitability and overall value creation throughout their operational lifespan. By evaluating their benefits against costs, we gain a more comprehensive perspective.

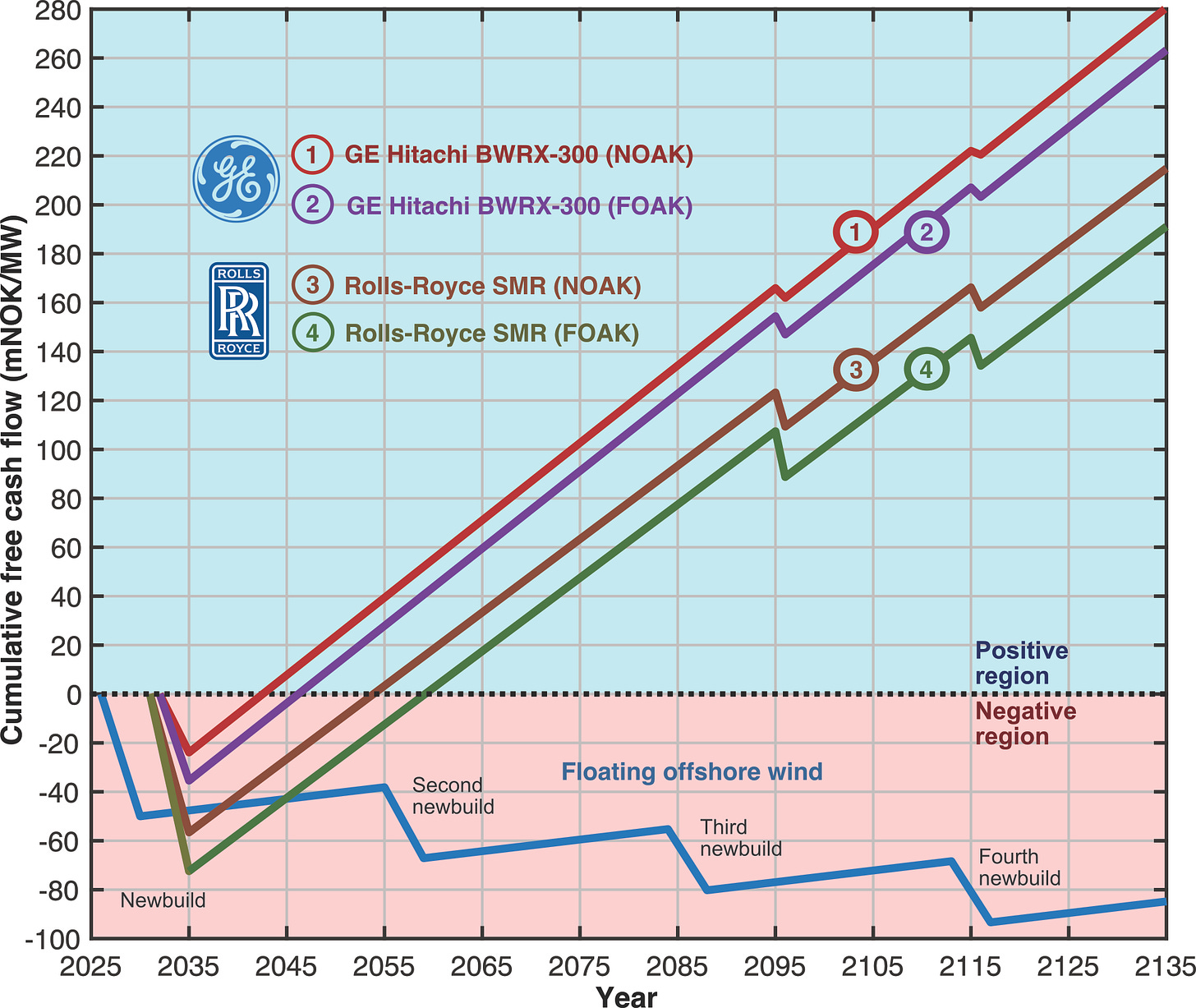

Figure 1 provides insights into the profitability projections for SMRs from GE Hitachi and Rolls-Royce, particularly if deployed in Norway by 2035. GE Hitachi's simpler and cheaper boiling water reactor (BWR) design, along with Rolls-Royce's advanced pressurized water reactor design, both show potential for profitability. Initially, first-of-a-kind (FOAK) SMRs will be less profitable than subsequent units (NOAK) due to the introduction of ‘economies-of-mass-production’ through series fabrication. In contrast, floating offshore wind does not exhibit comparable long-term profitability, even when considering significant capital expenditure (CAPEX) reductions after the first phase of newbuild.

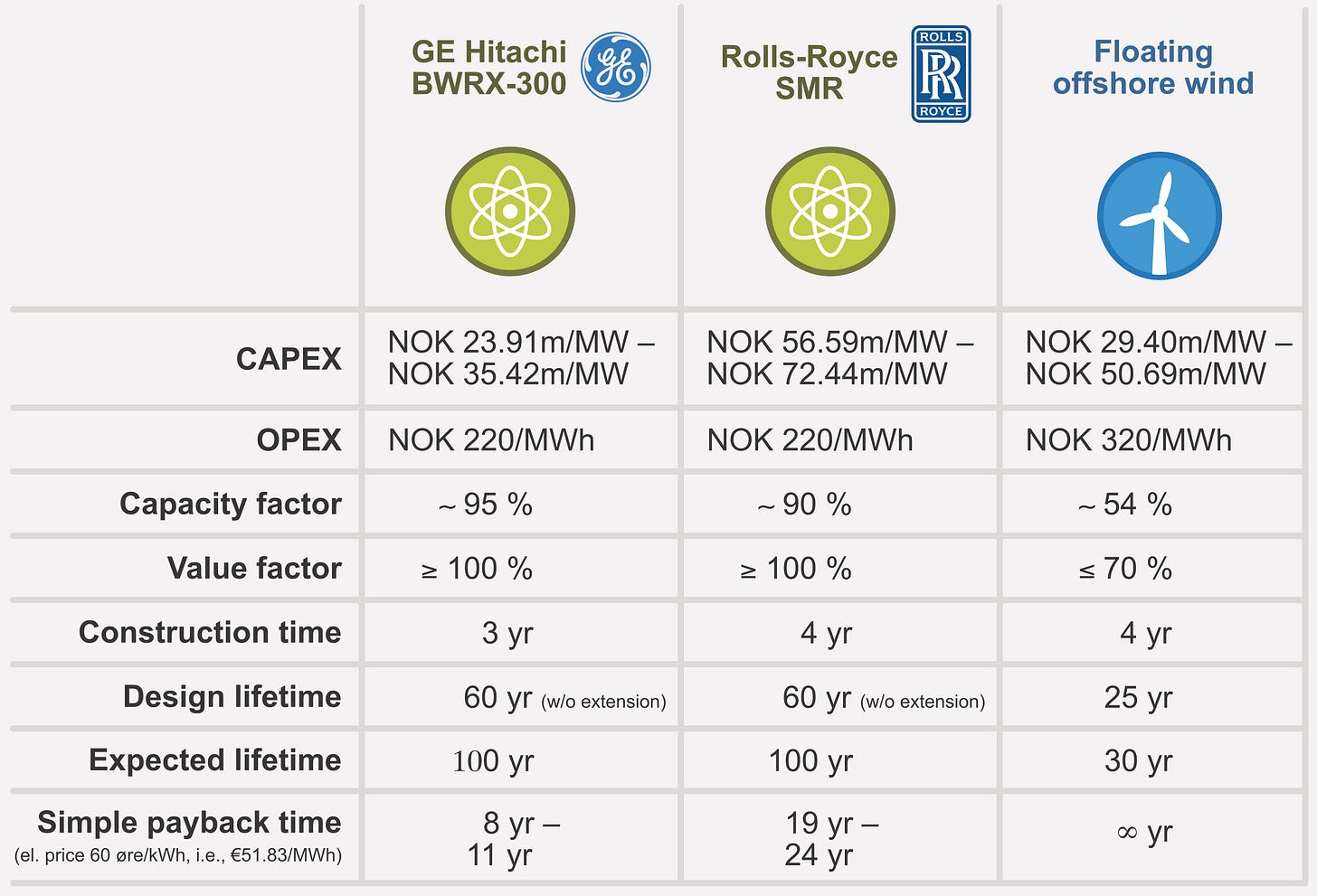

The simple payback time (SPT) for GE Hitachi's BWRX-300 ranges between 8 and 11 years, while Rolls-Royce's SMR yields a slightly longer SPT of 19 to 24 years. In contrast, offshore wind's payback time is indefinite, as it heavily relies on governmental subsidies or contracts for difference (CfDs) for viability.

All assumptions made to create Figure 1 are taken from Table 1 below. The assumption of a lower value factor or capture rate for offshore wind refers to the analysis made in an earlier piece comparing nuclear energy against wind energy.

The above analysis emphasizes the necessity of deploying small modular reactors (SMRs) for a more cost-effective energy transition in Norway. However, there are also other benefits to consider:

Deploying SMR units locally where they are needed can alleviate the pressure to expand the power grid. Excessive reliance on grid expansions delays the energy transition and makes it less cost-effective than necessary.

Nuclear energy offers the advantages of low marginal costs and high availability, enabling it to lower electricity prices consistently throughout the year. Reduced and more stable electricity prices will accelerate the electrification of Norwegian society.

Small modular reactors (SMRs) can serve as reliable baseload sources of electricity, which in turn enhances the flexibility of Norway's hydropower fleet, increasing its overall societal value. It also helps to address the Norwegian power adequacy problem.

There is no need to fear that the costs of small modular reactors (SMRs) will be excessively high. Opposing the deployment of SMRs in Norway based on cost considerations is unjustified. If they are not economically viable, there will be no incentive to build them. As demonstrated by the cash flow analysis above, it is floating offshore wind that proves to be expensive in terms of value creation and requires substantial subsidies. Therefore, we should consider SMRs as a promising subsidy-free alternative in Norway's green transition.

Najs. Kommer du på arendalsuka med noen slides og printouts?

Fin artikkel, Jonas!

Er det norske arbeidsplasser og kortsiktig gjenvalg på Stortinget som styrer politiske beslutninger om satsing på offshore vind? Og ikke langsiktig samfunnsøkonomisk nytte?

Bjarne Håkon Hansen mer enn antydet det nylig, og da må kanskje argumentasjonen vris i den retningen?

Og overfor energiintensive bedriftsaktører, feks Hydro på Høyanger, vil nok lcoe-kost og byggetid veie tyngre enn salgspris på strøm siden de bruker strømmen selv, og vil ha den raskest mulig.