New Swedish Study Unintentionally Advocates for Nuclear Energy

While the authors envisioned a heavily wind-dominated energy future for Sweden – excluding nuclear energy – an unforeseen revenue paradox emerges.

“Do as I say, not as I do” – John Selden's Table-Talk (c. 1654).

The researchers involved in a recent, non-peer-reviewed study assert their intention to maintain a balanced approach within the energy debate. Paradoxically, their actions appear to diverge from this goal, as they construct a report founded upon a speculative model heavily biased in favor of wind energy. Consequently, their efforts unintentionally contribute to the polarization they initially sought to avoid.

The study unapologetically favors ultra-high penetrations of onshore wind in Sweden’s energy future to propel Sweden toward its net-zero emissions goal. In the claimed cost-optimal scenario, onshore wind has a substantial 63.5 % market share within Sweden's energy mix. Additionally, an alternate scenario embraces offshore wind, with an impressive dominance of 72.4 %. Notably, both these trajectories stand in staunch opposition to nuclear energy, which remains conspicuously absent. However, a third scenario includes a 36.6% contribution from nuclear energy.

Concerns arise in the wind-dominated scenarios due to the absence of assured wind energy capacity expansion investments and the omission of revenue modeling for investment recovery. This gap is driven by the looming threat of "price cannibalization," characterized by prolonged periods of zero or negative electricity prices, ultimately yielding diminished revenues for wind energy producers.

Over the past 22 years, the captured electricity price for German wind farms has steadily dwindled to around 70% of the wholesale price. Extrapolating this trend linearly from Germany's historical data, the wind-centric scenarios project wind energy capture prices (or value factors) of 23.8% and 13.1%, respectively. However, it's worth noting that the linearity of the "self-cannibalization" effect could diminish at higher wind energy shares.

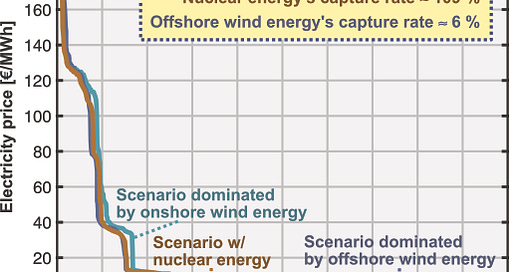

Regrettably, the recent Swedish study encountered challenges in convincingly modeling the power price dynamics (while others have tried and had some success). However, an attempt was presented in the preliminary draft of the work preceding the final release of the report on July 5th, 2023. This result is visualized in Figure 1 (excluded from the final report), where modeled electricity prices stand at €0/MWh for a substantial 73 % of the year, equivalent to approximately 6400 hours. This outcome translates to a mere 6 % actual capture rate for wind energy in the scenarios.

In stark contrast, nuclear energy, boasting an impressive 90 % capacity factor, achieves an astonishing capture rate of 109 %. As a result, the underlying work of the study unintentionally makes a case for nuclear energy without even realizing it.

An important clarification about the capture rate: it's an approximation based on Figure 1's duration curves (the authors did not provide these numbers in the report). The calculation merges the price curve with standard offshore and onshore wind energy production curves. It assumes minimal production at peak prices and maximal production when prices are zero. Even considering a flat wind energy production profile (however, unrealistic), only 2360 hours of non-zero electricity prices yield a capture rate of just 27 %. In addition, the 109 % nuclear energy capture rate estimate considers successful capture during 90% of the highest-priced hours, while a conservative estimate of 100 % could be considered.

The depressed capture rates (represented as value factors) for wind energy, as depicted in Figure 1, underscore a compelling incentive for substantial energy storage expansion, notably with technologies such as electrolyzer capacities for hydrogen production. However, this pursuit comes at a cost: the total expenditures for the wind-dominated scenarios will inevitably surge beyond the estimations outlined in the final report.

Assuming a modest increase in the wind energy value factor to 30% within wind-centric scenarios (and €35/MWh as the mean electricity price), Figure 2 reveals wind farms still struggle with profitability over the long term, even spanning a century. In sharp contrast, nuclear energy's notably higher value factor leads to a positive undiscounted cash flow in just 33 years. Despite the less-than-ideal payback time, the evident divergence is clear.

Onshore wind energy could also hypothetically have a positive free cash flow after 33 years with a revenue of €6.55/MWh (including OPEX), but that exceeds the expected lifetime. Who will invest in building new wind farms with a captured electricity price of roughly €10/MWh? This clearly shows that the investment model does not work to recoup wind energy investments in the claimed cost-optimal scenario of the recent Swedish study. Possible reasons could be that the researcher’s linear programming has not been formulated correctly.

The report calculated the wholesale electricity price to be in the range between €24/MWh and €35/MWh (depending on the scenario), which seems unrealistically low, considering that the Nordic power system is stronger connected to Europe. Here, high-marginal-price power plants dominate to set system balance, with sources like hydrogen, natural gas, or coal, including CCS or carbon tax. With a wholesale electricity price of €60/MWh, the simple payback time (SPT) of nuclear energy will be just 12 years. This is particularly low considering that standard nuclear power plants are built worldwide cheaper than €4m/MW assumed here.

All the assumptions needed to reproduce the stylized cumulative cash flow comparison in Figure 2 are provided in Table 1, which are based on the techno-economic metrics provided in the recent Swedish study, except wind energy value factors that were lifted to 30 %.

Disclaimer to the recent Swedish study: Remember that all models are wrong; some models are useful. The authors state on page 5 of the report that: “The calculations are made with a time resolution of 3 hours to capture the variability in wind and solar and the value of flexibility measures“. However, this is not a particularly high resolution to fully capture the intermittent nature of solar and wind energy. Moreover, a deterministic model has been used, assuming that the same weather from years 1991 and 1992 will be repeated far into the future. With a stochastic model that better resembles reality, the cost of a power system with a large share of weather-dependent energy resources will be much higher due to the inevitable need for over-dimensioning power lines and energy storage services.

The report states on page 11 that: “The method used for the calculations (cost-minimizing linear optimization) means that all investments receive cost coverage with the exception of nuclear power and offshore wind power in cases where they are forced into it.“ This statement is clearly impossible to fulfill given the low electricity price (must be above the LCOE) and the low capture rate for wind energy. If onshore wind energy is to be profitable, the capture rate should be at least above 90 %.

In addition to the recently published report, the authors have written an op-ed where they seem to be worried that the electrification will be too slow if Sweden focuses attention on new nuclear buildouts. The irony is that Sweden (and France) were setting the recent world record in decarbonization in the 1980s during the last nuclear energy buildouts while doubling the economy. No buildouts with solar or wind energies alone have not been even close to this achievement. The difference is astronomical.