Rystad Energy Spreads Misinformation About Europe's Largest Nuclear Reactor

If Rystad Energy wants to restore credibility, they must correct their recent nuclear energy report.

In November last year, Rystad Energy, a prominent energy consultancy firm, released a report on nuclear energy that has since stirred considerable debate in Norway. The report appears to inflate the costs of larger nuclear reactors, and it also underplays the potential of small modular reactors (SMRs).

Finland’s Olkiluoto-3 (OL3) is the most eye-popping example of larger nuclear reactors. OL3 is the largest nuclear reactor in Europe, boasting an impressive 1600-megawatt electrical capacity.

Rystad Energy's methodology and assumptions result in total costs that are over fourfold higher than those reported by the OL3 power plant owner. To summarize, they miscalculate the construction costs, capital costs, and operational costs and apply an incorrect method for calculating the normalized costs.

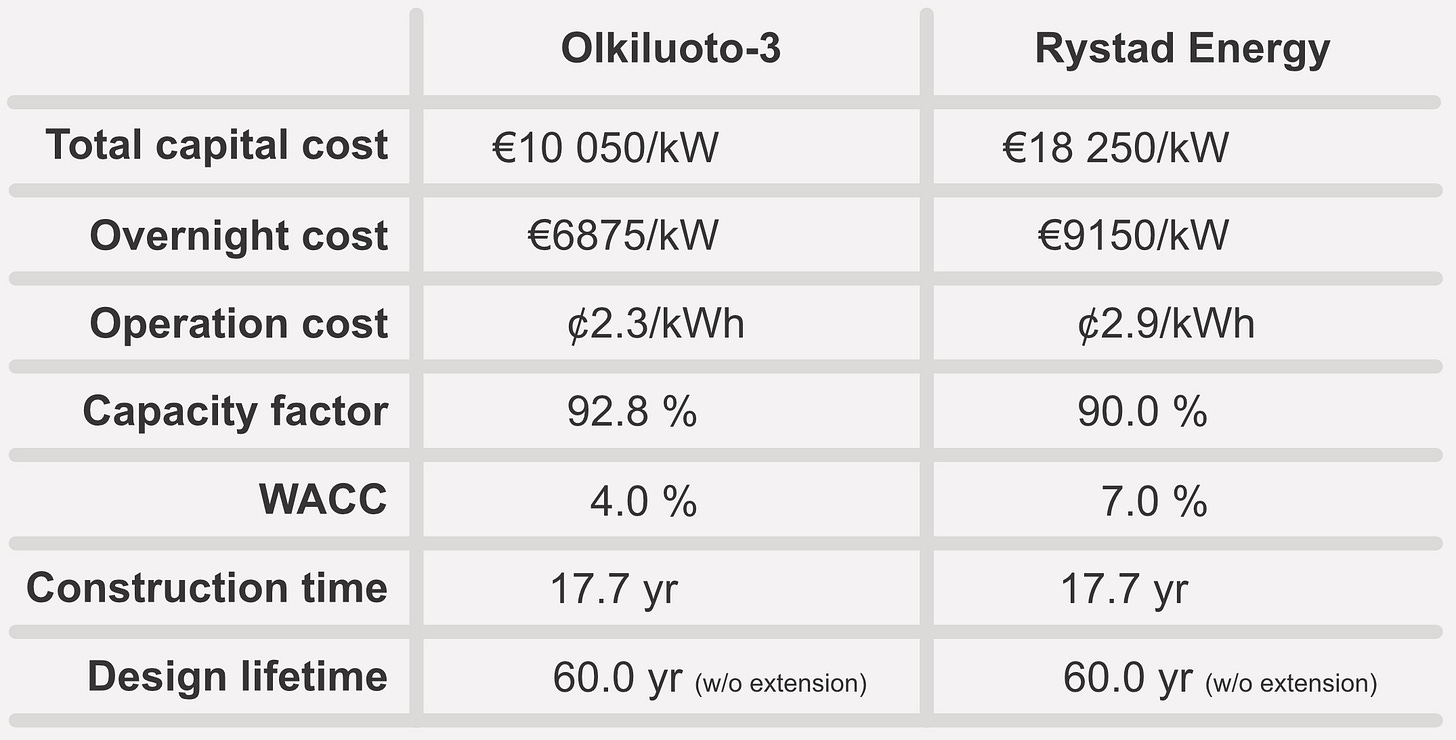

Firstly, OL3’s estimated construction cost, commonly referred to as the 'overnight cost,' is around €11 billion.

However, Rystad Energy’s report claims construction costs of €14.6 billion, excluding financing (see OL3’s €9.15/W CAPEX assumption in page 32). Their number implies an overestimation of more than 30 percent. There may be explanations for this discrepancy. However, their report does nothing to reveal sources, making it close to impossible to peer review. But the discrepancies don't end there.

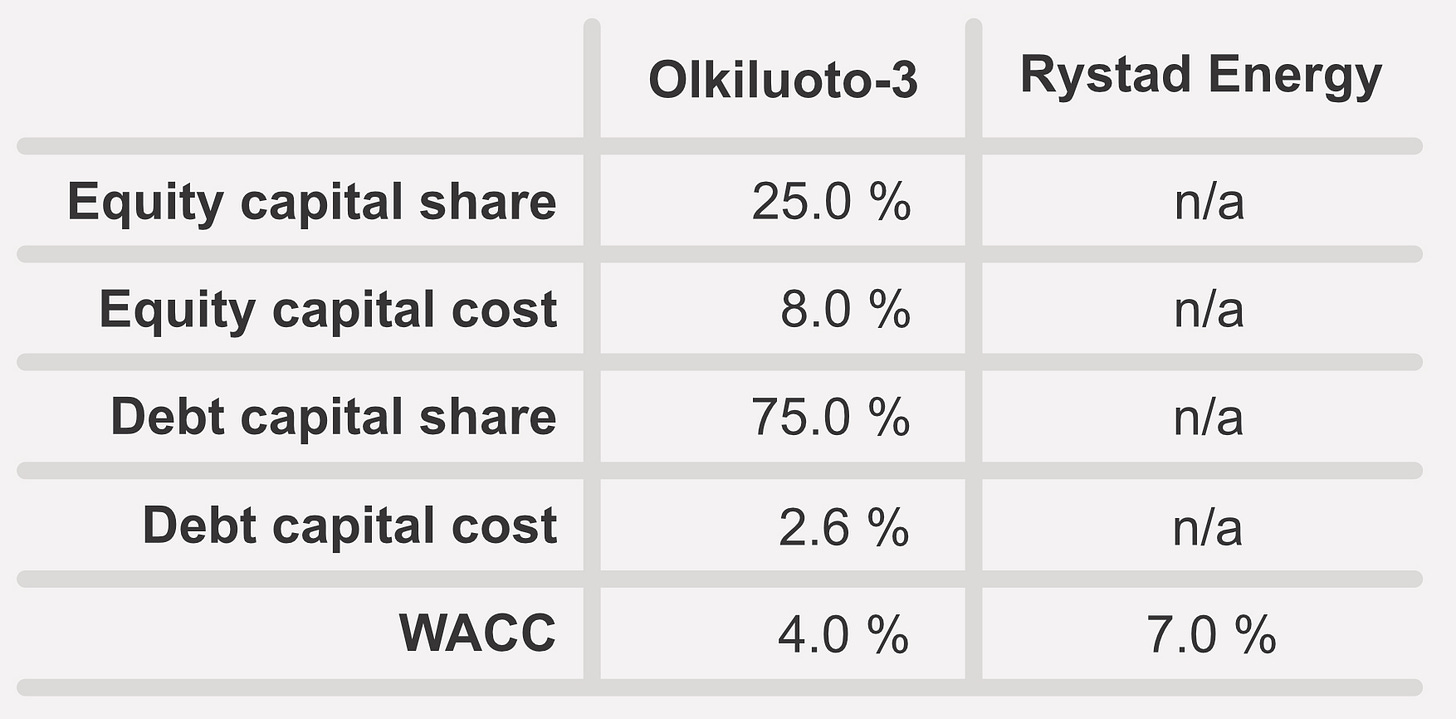

Secondly, Rystad Energy's financial analysis assumes a 7 percent interest rate for OL3, in stark contrast to the actual rate of approximately 4 percent. Intriguingly, this 4 percent rate is the same rate that Rystad applies to other technologies in their report. Rystad’s 7 percent interest rate assumption contradicts their premise that nuclear energy in Norway would rely exclusively on state financing. This inconsistency not only casts doubt on the firm's financial analysis but also suggests a potential bias in their approach and a lack of technology neutrality.

Lastly, Rystad Energy deviates from the common method for levelized cost of electricity (LCOE). It is, per definition, based on the cost of the customer that buys that power plant. When ordering wind turbines from Siemens Gamesa, you will not include their economic losses for a wind project.

On the contrary, in the case of OL3, Rystad Energy have incorporated economic losses from the supplier in France. They are allowed to do so, but it contradicts a common understanding of LCOE.

To be generous, let’s follow their uncommon LCOE practice anyway and see what we get.

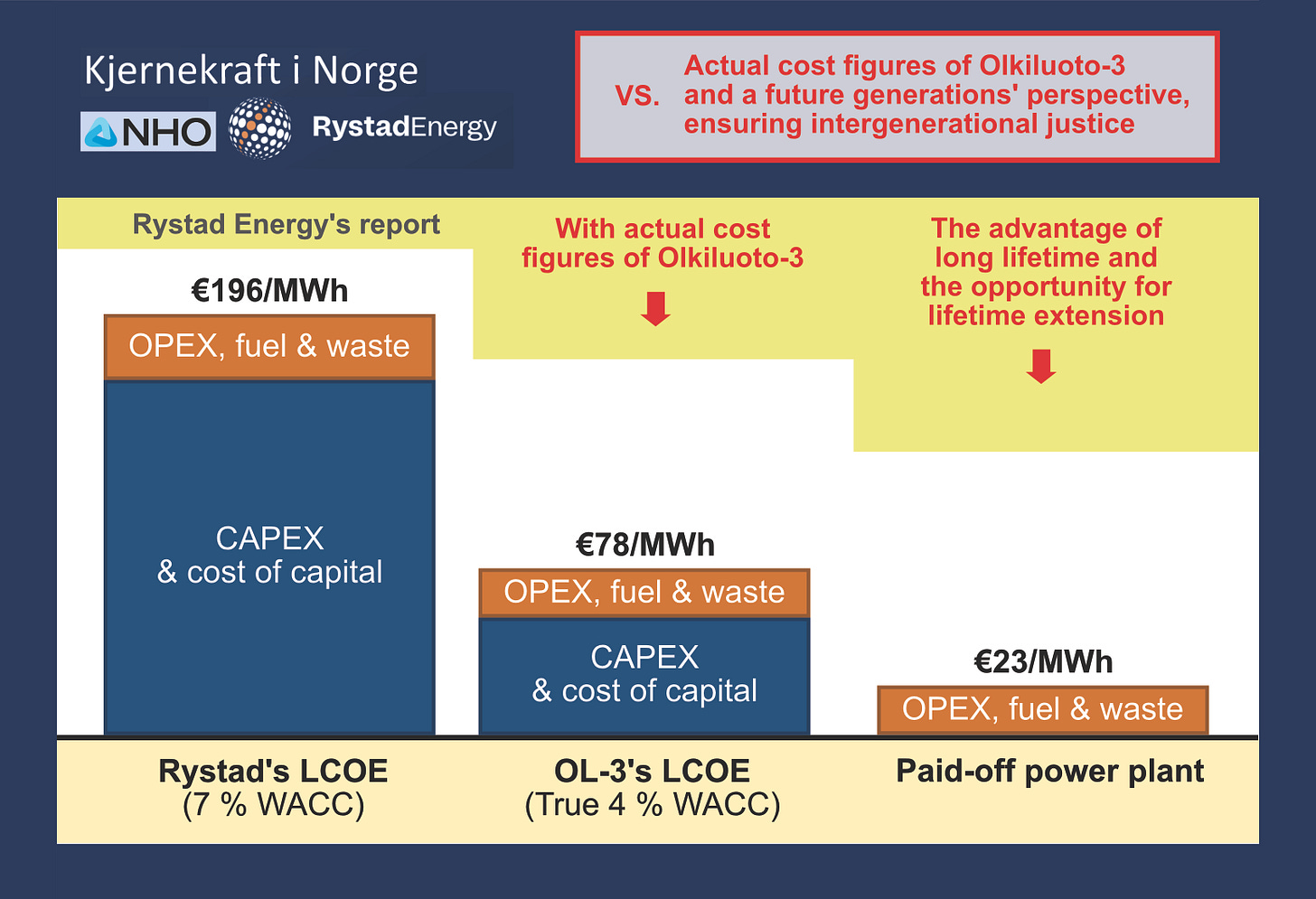

Figure 1 clearly illustrates the disparity in the LCOE for OL3 according to Rystad’s self-made definition (i.e., taking all economic losses into account, even the supplier’s losses). While the actual LCOE of OL3 stands at €78/MWh, Rystad Energy's methodology inflates this figure to €196/MWh (all inputs listed in the Appendix). This suggests that, according to their methodology, OL3 is two and a half times more expensive than it actually is. Their LCOE also aligns with the range reported by Bloomberg New Energy Finance (BNEF), which spans from €190/MWh to €375/MWh. Furthermore, when they extend their analysis to include other European nuclear projects like Flamanville-3 and Vogtle-3/4, they arrive at an average LCOE of €153/MWh (see page 29), still significantly higher than actual OL3 figures.

The LCOE for OL3 holds significance in the Norwegian context. The Norwegian Water Resources and Energy Directorate (NVE) forecasts the average electricity price in Norway to be around €71/MWh by 2030. Given the nature of nuclear power plants – their ability to operate independently of weather conditions and to produce electricity during periods of high demand – they typically capture prices around 10 percent higher than the average. This means a hypothetical Norwegian version of OL3 could effectively match the predicted electricity price with its LCOE of €78/MWh.

Nevertheless, this analysis overlooks potential additional income from participation in the balancing power market, where firm electricity providers can help maintain the grid's stability and are often compensated at higher rates.

OL3 is often labeled a 'disaster project' due to its nearly 18-year construction timeframe. However, it’s LCOE suggests it is on the brink of profitability in Norway, even without the need for subsidies. This is a striking contrast to the project's common perception and speaks volumes about the potential of nuclear energy, even in the Norwegian market.

But, the financial picture is even more promising when considering the actual construction cost reported by OL3's owners (TVO), which is €5.7 billion, significantly lower than the cost assumed in many public discussions. This reduced cost brings the owner’s LCOE down to just €52/MWh.

However, the owner goes even further and claims to have reduced their operational cost and calculates an internal LCOE of €42/MWh.

It can, of course, be argued that the cost of €5.7 billion is not the actual final construction cost for OL3, but it is, in fact, the price that TVO managed to negotiate based on expectations of what the project cost should have been. With lessons learned, it should be possible to achieve the initial expectations for the next projects.

To explain the discrepancy, it is important to note that OL3 is a first-of-a-kind (FOAK) reactor project. It involved the deployment of new technology and an immature design, which initially received economic support from the reactor supplier. This context is crucial in understanding why OL3’s actual LCOE is more favorable than commonly perceived.

The owner’s LCOE estimates of €42/MWh and €52/MWh both match well with Rystad’s assumption of a long-term electricity price of €50/MWh. In this scenario, OL3 would have captured a price of €55/MWh, i.e., higher than the owner’s LCOE.

Finally, to give Rystad Energy some credit, their report also contains some unbiased information about OL3, :

Olkiluoto-3 is operated by Teollisuuden Voima Oyj (TVO) – a Finnish industrial power corporation – which is also the power plant’s largest owner.

OL3 is the European version of the pressurised water reactor (PWR) and is therefore classified as a generation III+ EPR reactor.

It is based on new technology and, thus, considered a first-of-a-kind (FOAK) reactor.

Only 40 percent of the design was ready when the construction started.

Other challenges were inexperienced project management and unestablished supply chains.

With these facts in mind, even Rystad Energy will admit that there is a huge potential for cost reductions when Europe finally starts constructing standard reactors with proven technology and mature designs. Nonetheless, Rystad Energy’s key economic claims about OL3 are still false. Therefore, Rystad Energy should correct its report to restore credibility.

APPENDIX

Figure 1 is based on input parameters which are listed in Table 1 and Table 2.

Thank you for this. The amount of misinformation and biased reporting, often better described as slander and fear mongering, is truly frustrating.

I also try to give context and correct misinformation if possible, but it is an uphill battle.

We have it worse in Australia. Our Government scientific body (CSIRO) produces an annual report (Gencost) where it estimates the costs (LCOE) of different forms of electricity generation. It is quoted by renewable advocates as if it was the bible. However when you look at its assumptions, it assumes a plant life of a nuclear power station of only 30 years when the average ge of operating U.S. reactors is now 42 years. They assume a capacity factor of 50% when 90% would be more realistic. This makes a huge difference to the LCOE.